20 Common Bitcoin Myths Explained and Corrected

Confused by all the headlines, rumors, and second-hand opinions about Bitcoin? You’re not alone. Bitcoin is often misunderstood, partly because it’s so different from anything we’ve seen before. This post offers common Bitcoin myths debunked with facts and clarity, helping you separate noise from knowledge as we tackle 20 of the most persistent misconceptions.

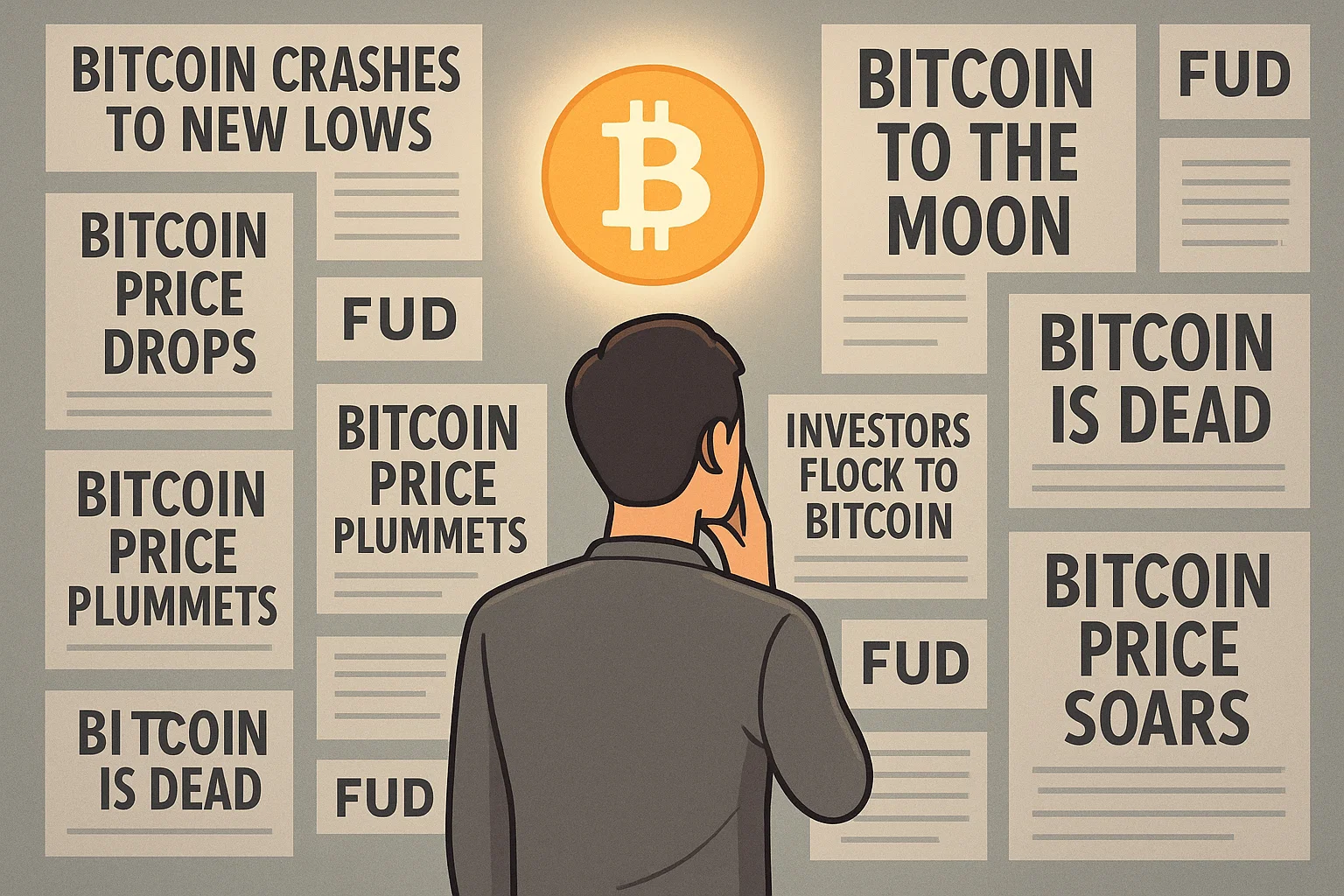

Confusion is common, but Bitcoin’s clarity comes with understanding. This visual captures the shift from FUD (fear, uncertainty, doubt) to insight. Use this guide to explore 20 myths that distort the truth about Bitcoin and the facts that correct them.

Did You Know? Many of the most popular criticisms of Bitcoin rely on outdated data or incorrect assumptions. This guide brings clarity, with facts and context that shift the conversation.

20 Common Bitcoin Myths Explained and Corrected

Click each myth to learn more

| # | Bitcoin Myth | Truth and Explanation |

|---|---|---|

| 1 | Bitcoin Uses Too Much Energy | Bitcoin’s energy use secures the network and is increasingly powered by renewable energy. Unlike fiat systems, Bitcoin makes energy consumption transparent and auditable. |

| 2 | Bitcoin Is Too Volatile to Be Useful | Volatility is a feature of early adoption. Over time, Bitcoin has stabilized compared to its early years and continues to outperform other assets over the long term. |

| 3 | Bitcoin Is for Criminals | This myth is outdated. Blockchain forensics make Bitcoin one of the worst choices for crime. Cash is still the top tool for illicit activity. |

| 4 | Bitcoin Is a Speculative Bubble | Every new technology sees cycles of hype. Bitcoin’s long-term trajectory shows a steadily growing base of users, infrastructure, and utility. |

| 5 | Bitcoin Can Be Stopped by Governments | Governments can restrict access, but they can’t stop the protocol. Bitcoin’s decentralization and global distribution make it censorship-resistant. |

| 6 | You Need to Buy a Whole Bitcoin | Bitcoin is divisible into 100 million sats. You can buy $1 worth. This myth confuses unit pricing with minimum investment. |

| 7 | Bitcoin Has a Physical Form or Utility | Bitcoin is digital property. Its value lies in verifiable ownership and permissionless transfer, not physical delivery. |

| 8 | Altcoins Are Better Than Bitcoin | Altcoins often trade innovation for centralization. Bitcoin remains unmatched in decentralization, network effect, and security. |

| 9 | Real Estate and Stocks Are Better Investments | Real estate and equities have value, but they come with liquidity issues and counterparty risk. Bitcoin is global, portable, and provably scarce. |

| 10 | Bitcoin Physically Resides in Your Wallet | Wallets store your private keys. The coins live on the blockchain ledger. Your wallet grants control, not possession of digital units. |

| 11 | Exchanges Are Safe Places to Store Bitcoin | Not your keys, not your coins. Centralized exchanges carry risk of loss, hacks, or frozen funds. Self-custody ensures sovereignty. |

| 12 | Bitcoin Should Be Redistributed or Reset | Bitcoin’s fairness comes from its rules being the same for everyone. Changing the rules to redistribute would break that trust and neutrality. |

| 13 | Gold Is Superior to Bitcoin | Gold is hard to audit, divide, or move globally. Bitcoin is programmable, borderless, and easily verified in real time. |

| 14 | Bitcoin Has No Intrinsic Value | This myth assumes value must come from physical use. Bitcoin’s value derives from cryptographic scarcity, immutability, and freedom to transact. |

| 15 | Bitcoin Is a Greater Fool Game | Bitcoin is a neutral protocol. It doesn’t rely on fooling anyone. Those who study its design often shift from critics to holders. |

| 16 | Bitcoin Is Centralized by Miners | Miners produce blocks, but they do not control Bitcoin’s rules. Users and node operators enforce consensus across the network. |

| 17 | Bitcoin Is a Ponzi Scheme | There’s no central party promising returns. Bitcoin is open-source, decentralized, voluntary, and not dependent on new investors. |

| 18 | Bitcoin Is Too Complicated for Mass Adoption | Most people don’t need to understand TCP/IP to use the internet. Bitcoin tools are improving rapidly, making it easy for anyone to participate. |

| 19 | No One Accepts Bitcoin | Tens of thousands of businesses accept Bitcoin, and the number grows each year. Lightning payments make it practical even for small shops. |

| 20 | Bitcoin Can’t Be a Unit of Account | Bitcoin is already used to denominate contracts, invoices, and salaries in some circles. As volatility decreases, so will reliance on fiat terms. |

Bitcoin enables digital property rights for the first time because it’s the world’s first digital bearer instrument.

Alex Gladstein, Human Rights Foundation

This article offered common Bitcoin myths debunked with facts and clarity. Truth matters. Learn more and decide for yourself.

Explore the Myths

From scarcity comes abundance.

That’s the promise. That’s the power. That’s Bitcoin.