Bitcoin Is Too Volatile to Be Useful | Bitcoin Myths #2

Volatility is not a flaw, it is part of the design of a new, global form of money. While Bitcoin fluctuates more than traditional assets, that movement reflects growth and adoption, not failure. Over time, the swings tend to settle, and the long-term trend supports preservation of value. Many people believe that Bitcoin is too volatile to serve as a reliable currency or investment. While price swings are real, they don’t tell the full story.

Myth #2: Bitcoin Is Too Volatile to Be Useful

One of the biggest Bitcoin myths is that it’s too unstable to matter. While price swings can be dramatic in the short term, this volatility is not a flaw, it’s a natural part of Bitcoin’s growth as an emerging form of money.

Understanding Bitcoin’s Volatility

Bitcoin’s price fluctuations are largely a function of its youth and global reach. As a 24/7 market that never closes, it reacts instantly to news, sentiment shifts, and changing adoption levels. Its value is not determined by earnings or balance sheets, but by how many people believe in its role as money.

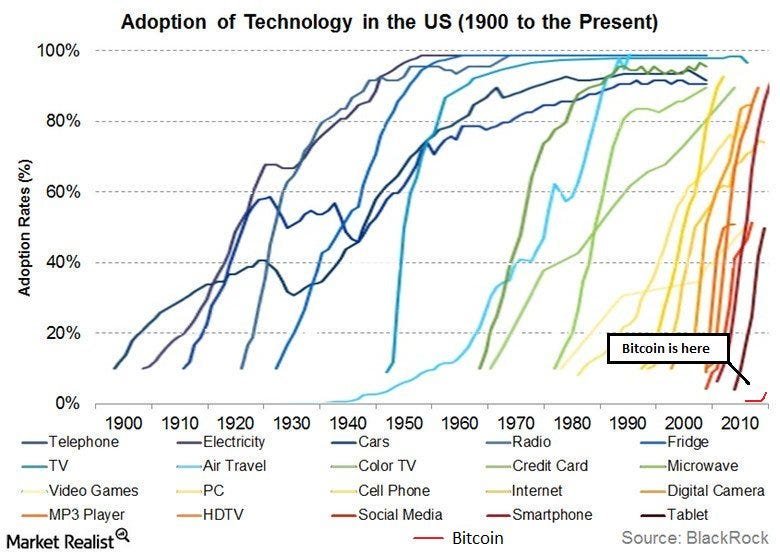

Like all new monetary assets, Bitcoin moves through adoption cycles: rapid surges, corrections, and periods of consolidation. These cycles mirror the hype waves seen in major technologies like the internet. Over time, as liquidity increases and adoption spreads, volatility is expected to decline.

Why Volatility Is Not a Long-Term Problem

In fact, volatility has played a role in Bitcoin’s growth. The potential for large price increases encourages early adopters, who take on more risk in exchange for greater upside. These participants help expand the network, leading to more stable prices over time.

Chart comparing Bitcoin’s volatility to stocks, debunking common Bitcoin myths.

Traditional currencies may feel more stable day to day, but they lose purchasing power gradually through inflation. Bitcoin is transparent in its monetary policy and cannot be inflated at will. The price may fluctuate, but the system is predictable.

Did You Know? Although critics often say that Bitcoin is too volatile to be useful, long-term data tells a different story. In fact, Bitcoin has been the best-performing asset class over the past decade, significantly outpacing stocks and gold.

Source: Fidelity Digital Assets

What About Using Bitcoin for Payments?

Today, most people use Bitcoin as a store of value rather than a currency for daily spending. That’s partly because of its upward price trend. Many would rather hold than spend. But tools like the Lightning Network are making small, instant payments easier, paving the way for Bitcoin to become a medium of exchange as well.

As Bitcoin’s value stabilizes with growth and maturity, spending it will feel less like missing out. Until then, second-layer solutions are bridging the gap.

In Regions Plagued by Hyperinflation

Bitcoin’s short-term price swings mean little in places where fiat currencies are collapsing. In these regions, Bitcoin provides a better alternative—one that preserves value, offers liquidity, and bypasses broken banking systems.

Global Bitcoin Adoption in Response to Fiat Collapse

| Country | Details |

|---|---|

| Venezuela | The collapse of the bolívar in Venezuela is noted as a “stark reminder of the human cost of hyperinflation,” with many Venezuelans turning to Bitcoin and other cryptocurrencies as “lifelines” to preserve wealth and facilitate cross-border transactions when traditional systems fail. |

| Nigeria | Despite its volatility, Bitcoin is considered a better asset in Nigeria, where the local currency (naira) can decrease in value by 30–40% in a year, making Bitcoin’s short-term fluctuations irrelevant for long-term saving. Nigeria also has among the highest Bitcoin adoption rates in the world, with over 30% of people using it for peer-to-peer transactions due to its utility in getting around capital controls and for international trade. |

| Turkey | When Turkey’s lira lost 44% of its value in 2021, many citizens turned to Bitcoin as a store of value. Bitcoin serves as a lifeline in Turkey, where local fiat currencies are plagued by hyperinflation and capital controls. |

| Argentina | In Argentina, where currency controls are a fact of life, Bitcoin provides an alternative to the black market dollar trade and helps people get around capital controls. |

| Lebanon | Bitcoin’s liquidity and value preservation are critical in Lebanon, where local fiat currencies are unstable. |

| Zimbabwe | People in Zimbabwe do not care about Bitcoin’s volatility because it holds value better than their constantly devaluing local currency. Their purchasing power goes up and cost of living goes down when saving in Bitcoin. Zimbabwe’s experience with hyperinflation illustrates the dangers of unchecked money creation, prompting a need for alternatives like Bitcoin. |

📘 Source: Livingston, Adam. The Bitcoin Age. Copyright © 2025. Quoted from Chapter 3: Challenges and Misconceptions. All rights reserved.

Challenging Bitcoin myths helps show why its volatility doesn’t cancel its long‑term value.

Key Takeaways

Volatility is normal during Bitcoin’s monetization process. It is expected to decline as adoption and market maturity increase.

Bitcoin is liquid, global, and always open. It operates 24/7, unlike traditional markets with limited hours and borders.

People in unstable economies turn to Bitcoin because it holds value more reliably than local fiat currencies.

Volatility does not mean failure. It reflects a free, open market where price discovery happens in real time.

From Scarcity Comes Abundance

That is the promise. That is the power.

That is Bitcoin.

Still on the fence about Bitcoin’s future?

You’re not alone. But the more we ask questions, the more we uncover.

If you’re serious about understanding Bitcoin beyond the headlines, explore the full Bitcoin Myths series